A home equity loan or line of credit history (HELOC) permits you to faucet into any fairness you have by now amassed by way of having to pay off your mortgage to release a lump sum that could then be utilized to spend in your addition.

As an alternative to developing a wholly new room, micro additions, in any other case referred to as bump-out additions, lengthen from existing rooms. For that reason, they provide a simpler and much less expensive selection for those who don’t really feel like they want as much further Room.

Which has a home equity loan, your house is made use of as collateral. Which means lenders can offer you lessen fees as the loan is secured from the home. The lower, mounted fascination level will make a home equity loan a fantastic alternative if you'll want to borrow a substantial sum.

Having explained that, the cost of the addition without doubt causes it to be a large fiscal motivation and so picking out the ideal financing solution is a crucial decision.

Home fairness loans may offer more affordable costs than a number of the other loans obtainable as the home is utilized as collateral over the loan, minimizing the lender’s risk.

Certainly, it is normally possible to borrow more in opposition to your home to finance your extension. This involves getting extra money from the recent home loan lender to fund the renovation project, spreading the repayments about a long term.

Stability of your loan would generally be security fascination to the assets becoming financed by us and / or almost every other collateral / interim security as might be needed by us.

Those who aren’t prepared to part with their home can be drawn to the concept of a home remodel or addition, but with any significant home enhancement, homeowners will need to be prepared to consider several variables in advance of they could split ground ต่อเติมบ้านไม้ on their project—like how to address their home renovation costs.

There may be some laid bearing partitions you just can’t take away or regions without the need of plumbing or electrical that will require much more specialty subcontractors to complete.

If it's essential to use a credit card to fund your renovations, make an effort to submit an application for a card using an introductory 0% yearly share price (APR).

A next charge home loan is also referred to as a secured charge loan and it consists of retaining your present-day offer as it really is while getting A further mortgage loan lender who'll grant you an additional deal. Using this arrangement, repayments must be compensated on each mortgages at the same time.

The initial of such is that you'll be pressured to refinance your home, generally onto a A great deal better fee than you’re at present on and, Because of this, you could possibly wind up shelling out increased regular payments in the method.

We have found GIA to become really professional and versatile in meeting our desires. GIA team members are generally courteous and mindful of leaving our home within a clean condition immediately after each and every move of the renovation is progressively done.

Including onto ต่อเติมบ้าน กฎหมาย your present Room to make your own desire home can the two dramatically increase the price of your assets by rising your home’s livable sq. footage.

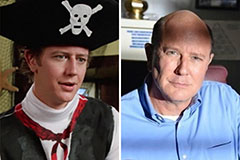

Judge Reinhold Then & Now!

Judge Reinhold Then & Now! Joshua Jackson Then & Now!

Joshua Jackson Then & Now! Barry Watson Then & Now!

Barry Watson Then & Now! Elisabeth Shue Then & Now!

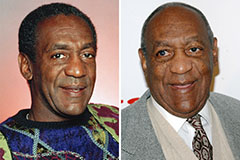

Elisabeth Shue Then & Now! Bill Cosby Then & Now!

Bill Cosby Then & Now!